Accounting - BS

Provide the analysis that will help businesses make financial decision and be front and center as part of a management team.

Why study accounting at Pitt-Bradford?

Because what you keep is as important as what you earn! The demand for accountants is at an all-time high. This translates to some of the highest entry-level pay in business. Accounting will fast-track your career in finance, manufacturing, auditing, investing, taxation, and government.

The accounting program at Pit-Bradford is unlike any other. You’ll receive a large-school education and a small-school connection. Our degree leverages Pitt-Bradford’s growing network of successful accounting and finance alumni to give you the best jobs possible. The placement rate of our recent graduation class was 100%. That means our grads are working on Day One and on their way to great careers.

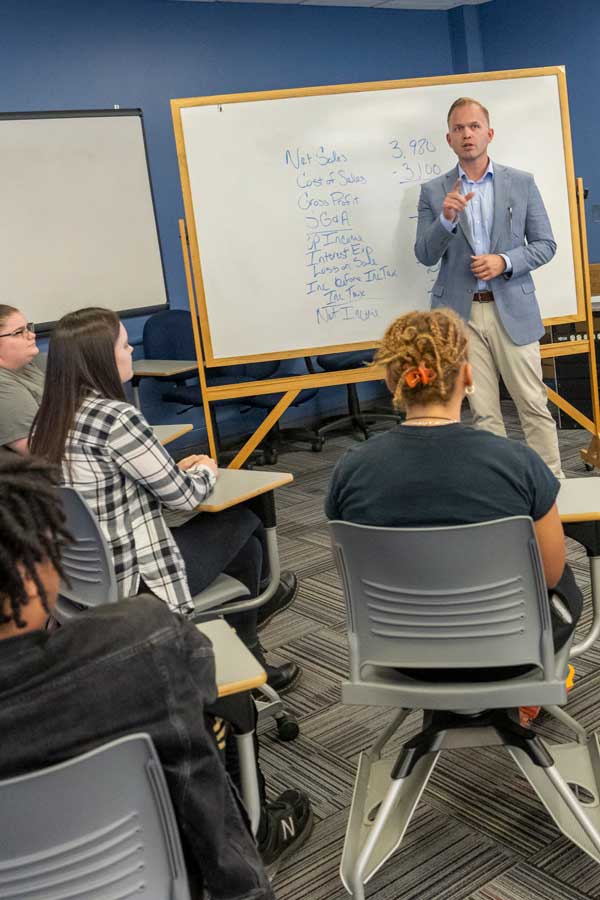

The accounting and finance faculty members have all worked in industry, so we know exactly what skills employers seek. Our approach to education is best to prepare our students for careers in the Real World.

What will I learn?

You'll study financial accounting and strategic cost management. You’ll take a deep dive into corporate incomes taxes, auditing, corporate finance and investments. You’ll also have the chance to intern with a public accounting firm, which will look great on a resume.

What can I do with a degree in accounting?

Once you earn your accounting degree, you'll be on track to get certified and become a certified public accountant, which will prepare you to work just about anywhere. A small business or large corporation. For the government such as the FBI, IRS or the DEA. In an accounting firm. Or, you could be a forensic accountant and help detect fraud and money laundering.

Job titles:

- Accountant

- Internal auditor

- Financial controller

- Mortgage representative

- Actuary

- Bank manage

- Bookkeeper

- Budget analyst

- Consumer credit officer

- Financial analyst

Employers:

- Accounting firms

- Banks

- Consulting firms

- Corporations

- Financial service companies

- Government agencies

- Industry

- Nonprofit organizations

- School systems

Success Stories

Rachel Mertz '24

For Rachel Mertz, Pitt-Bradford was more than just a step toward a degree, it was where she discovered her true passion for accounting.

Jackson McManus '24

Jackson McManus ’24 didn’t always know he’d end up in accounting. When he first arrived at Pitt-Bradford, basketball—not numbers—brought him to campus.

Veronica Shaffer '24

Before attending Pitt-Bradford, Veronica Shaffer was studying engineering at a university in Ohio and came to a difficult realization: None of it was working for her.

-

ACCT 0201

Financial Accounting ConceptsThis course provides the fundamentals of accounting principles and practices. It presents information on the decision-making processes to those external to the business owners, investors, potential investors, creditors, and the public at large. -

ACCT 1303

Strategic Cost ManagementThis course focuses on advanced topics in cost and managerial accounting. Emphasis is on standard cost systems and variance analysis; absorption and variable costing; capital budgeting techniques and income tax impact assessment; and short and long range forecasting and reporting.

Program-Related News

Pitt-Bradford named a College of Distinction

Campus recognized for affordability and business, education and nursing programs.

Warren family establishes business fund

Jarzab Family Business Fund will pay for ‘extras’ like guest speakers, projects or field trips.

Graduates head to police academy, graduate school

New grads include first environmental engineering technology graduate.