Financial Aid

Nearly all students who apply and have need for financial aid — 99.4% — receive some form of assistance.

The Free Application for Federal Student Aid for 2026-27 is now available!

This applies to Fall 2026, Spring 2027 and Summer 2027 and uses 2024 Federal Tax information.

To ensure Pitt-Bradford receives your FAFSA information, use school code 008815, which is the correct code for all University of Pittsburgh campuses.

For those seeking Financial Aid for Fall 2025, Spring 2026, and Summer 2026, please complete the 2025-2026 FAFSA and use 2023 Federal Tax information if you have not already done so.

Office Hours:

Fall and Spring terms: 8:30 a.m. - 5:00 p.m. Monday through Friday EST/DST

Summer: 8:00 a.m. - 4:30 p.m.

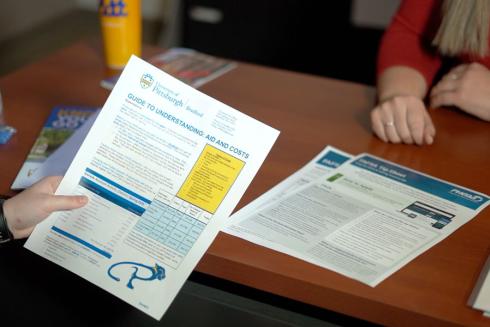

Affordability

Most of our students receive financial aid, so they’re not paying the full amount for tuition and fees. Check out our examples to get a better idea of what you may pay.

Pitt Pell Plus Grant

As a part of the University's commitment to investing in students who have the greatest financial need, the Pitt Pell Plus Program will match any Federal Pell Grant awarded up to the federal maximum Pell Grant amount of $7,395 for the 2023-2024 academic year, not to exceed the financial aid budget.

Scholarships

We have a wide range of scholarships to help you with your education. Take a minute to review our list of scholarships. Then, you can make an appointment to meet with a financial aid counselor.

Scholarship Help

If you need a scholarship application filled out, you can email it to UPBaid@pitt.edu. Kindly give us at least 2 weeks to complete and return or submit the form.

Tuition and Fees

Our basic room and board rates are among the top five most affordable for four-year public universities in Pennsylvania.

Our FAFSA code is 008815

The Free Application for Federal Student Aid for 2026-27 is now available. To ensure Pitt-Bradford receives your FAFSA information, use school code 008815, the correct code for all University of Pittsburgh campuses.

To contact the financial aid office please call 814-362-7550 or email: UPBaid@pitt.edu.

Our Staff: